Press release -

Suppliers: Achieving the drive transition with used industrial robots

Switching to electromobility is among the greatest challenges facing automotive suppliers. They currently lack certainty about investments, which are nevertheless necessary. Used automation systems can be purchased in order to minimise expenditure during the transitional phase from conventional to alternative drive systems.

Still a long way to go for climate-neutral vehicles

It will take quite some time before automotive production has made the switch to zero-emission drive systems. At present, it is not even clear which technology will prevail. Battery-powered vehicles are currently leading the field, closely followed by fuel cell drive systems and hybrid cars that run on e-fuels.

Even after a certain type of drive has become established, a wide range of possible concepts is still available. There are, for instance, various types of electric motor (DC or AC, synchronous or asynchronous motors, independently or permanently excited etc.). The electric motor can be mounted close to the axle, that is, integrated into the axle geometry, or close to the wheel. The number of electric motors also depends on this aspect. Will each wheel or only each axle have a motor – or perhaps a combination of the two? There is certainly a wide range of design options.

Dealing with significant uncertainty

There is currently a lack of certainty about investments that suppliers will have to make. One thing is clear, though: The new generation of drive systems will require completely new parts and more flexibility in production than ever before. This means that investments will have to meet all the requirements.

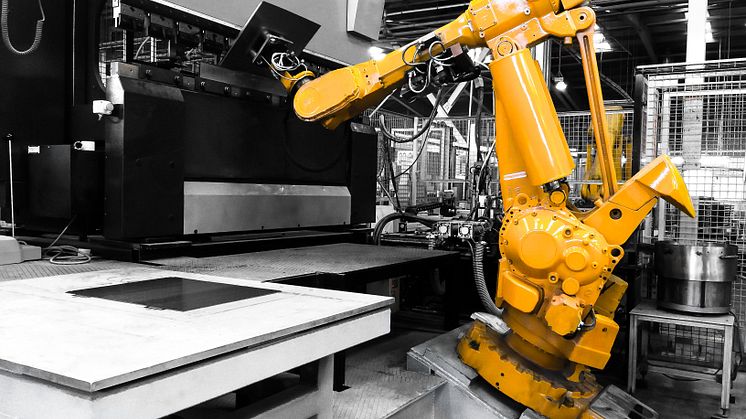

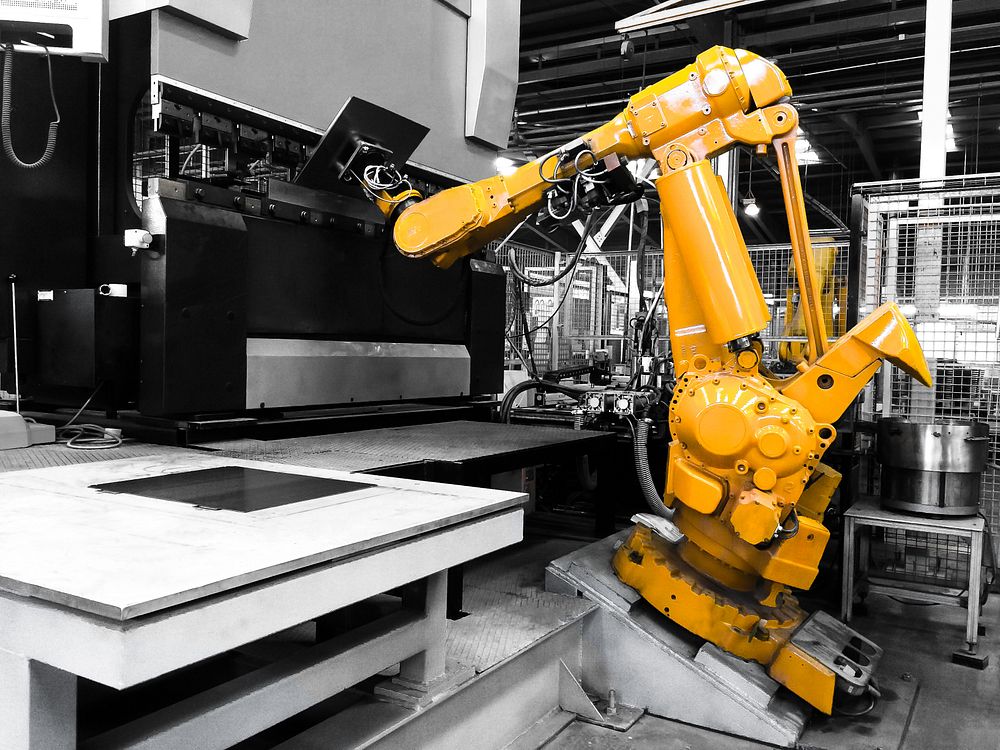

The solution will be to implement automated and therefore flexible production lines. Doing so enables fast responses to the changing needs of car makers. What is more, production will remain profitable, even for small unit numbers. Broadly speaking, many supplier parts consist of processed sheet metal. Robot handling is one efficient automation method of loading workpieces into presses and other metalworking machines.

Minimising the investment risk

Although China is clearly ahead in the global production of electric cars, the European market still leads the field. This is because local car makers have a higher proportion of electrified vehicles in their production portfolio, compared to their competitors from the Far East. Vehicle manufacturers from Asia and America will need to invest more in production if they want to close the gap. The forecasts are promising as well: In less than a decade, car makers will generate more profits with electric vehicles than they do with those powered by combustion engines. Electric cars will account for 40% of the market in 2030.

Used automation systems can be purchased for flexible manufacturing in order to minimise expenditure during the transitional phase from conventional to alternative drive systems. The Surplex.com auction platform for used machinery and operating equipment is offering industrial robots (FANUC and KUKA) from a German car manufacturer until 17/01/2023. The robots are suitable for various uses: They can take charge of handling tasks or spot welding, which enables their deployment in metalworking industries and in the supplier sector.

About Surplex

Surplex is one of Europe’s leading industrial auction houses and trades worldwide in used machines and factory equipment. The 16-language auction platform Surplex.com is visited around 50 million times every year. It sells more than 55,000 industrial products per year in over 500 online auctions. The company is based in Düsseldorf and has offices in 15 European countries. Over 200 employees from 20 different nations generate an annual turnover of more than 100 million euros.